Quick Win — Your Altseson Exit Map Is Free Online

History’s best peak indicators, all in one chart. Use it.

The hardest decision in a bull run is when to sell.

Not buying, not holding through the ugly dips — selling.

Most people either jump ship too early or hang on until the whole thing pull back. Both moves come from the same place: guessing. And guessing doesn’t work in markets that are built to fool you.

Here’s a way around it:

stop guessing and use a dashboard that does the heavy lifting.

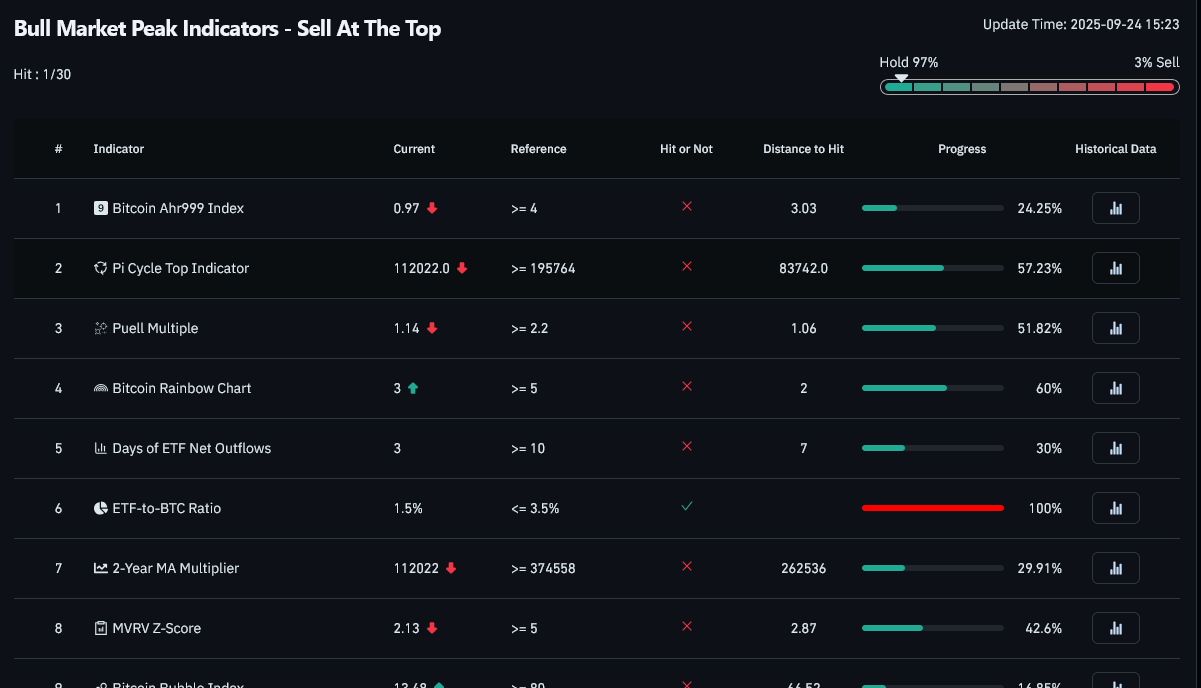

CoinGlass has a free page called Bull Market Peak Indicators. It tracks 30 signals that have historically lined up with overheated markets — Pi Cycle Top, MVRV Z-Score, Puell Multiple, RSI, you name it.

You don’t need to study each one. Just look at the scoreboard:

If only 1 or 2 are flashing red → ignore the noise.

If 10+ start lighting up → pay attention.

If the board is nearly full → the party’s almost over, time to scale out.

Right now, it’s dead quiet. That’s useful in itself: it tells you we’re not near peak euphoria. Yet.

The win for you is simple: bookmark that page, check it once a week.

It takes 20 seconds and gives you an unemotional reference point when the headlines and X threads are screaming “TOP IN” or “150K next week.”

No single indicator is perfect. But a wall of them lighting up at the same time? That’s not noise. That’s your cue to stop chasing and start protecting profits.

Because selling isn’t about hitting the exact top. You just can’t. But you can walk away with more chips than you started with…

See you soon.

— A.Z., Freedom Finance

Don’t know where to start with crypto?

Skip the influencers. Skip the hype.

I’ll teach you the basics in 5 emails — from wallets to portfolios to spotting scams.

Free, no strings attached.

P.S. I wrote a mini-book on the #1 reason people lose money in crypto — wasting hours on coins that never had a chance.

It’s called “The 10-Minute Crypto BS Detector.”

Inside: the 9 brutal checks I run on every coin to kill the obvious scams, unlock traps, and whale games — all in under 10 minutes.

Plus: a printable scorecard, flow map, and the AI prompts I use to cut research time in half.

Money moves in cycles, patience wins, and most people panic at exactly the wrong time. That’s what we cover here at Freedom Finance—real market moves, actual strategy, none of the usual nonsense.

We’re also running a $100 Portfolio as a public experiment. No magic formulas, no hype—just seeing what happens when you invest small, stay consistent, and make decisions like an actual investor. Because if you can’t manage $100, why would you handle $10,000 any better?